There are currently no blog posts.

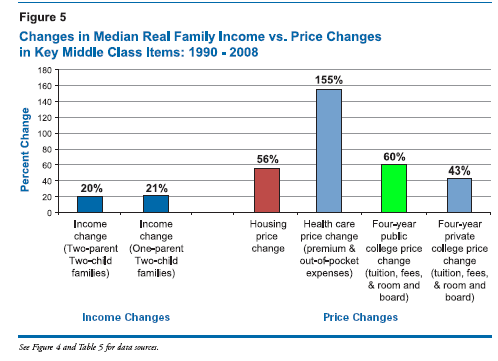

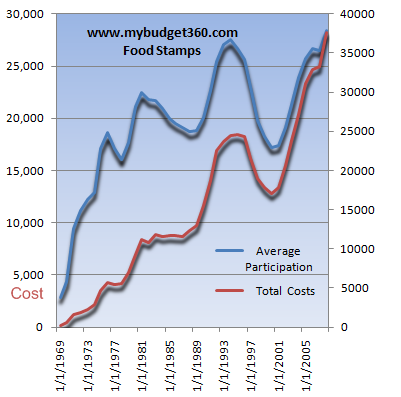

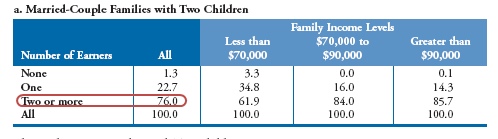

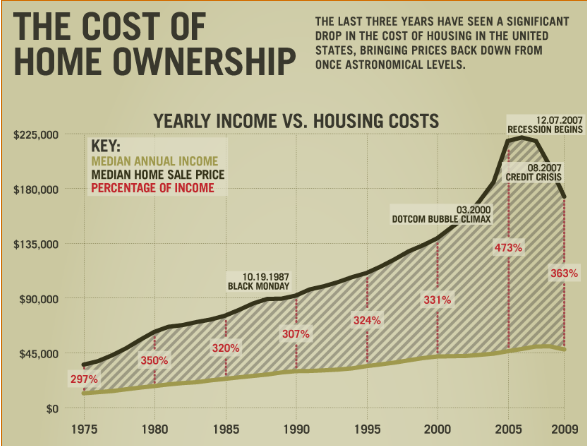

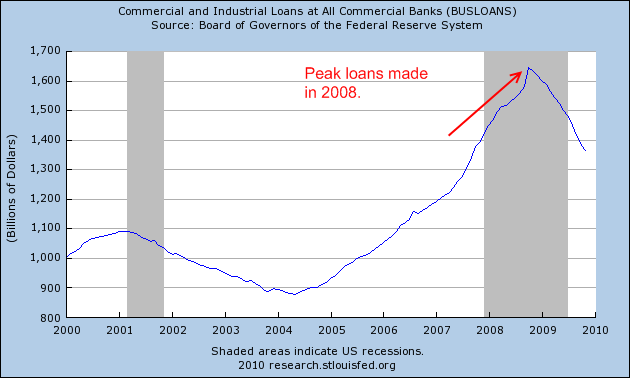

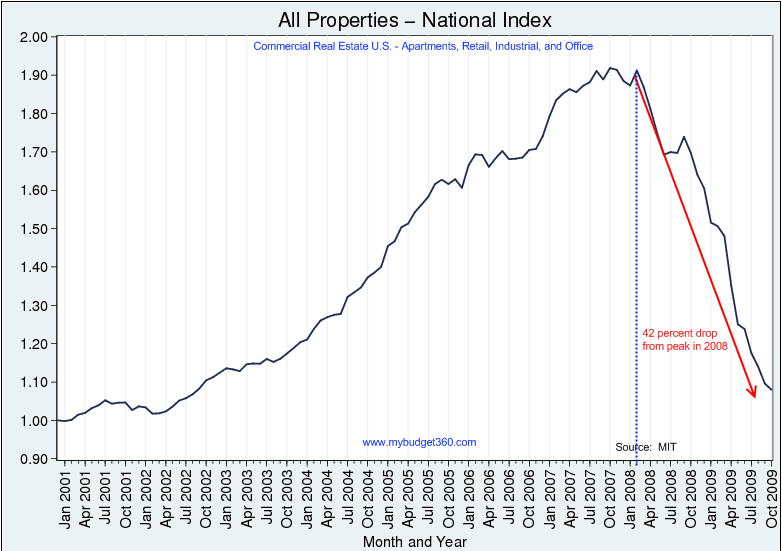

Game Over for the American Middle Class – Inflation Adjusted Wages up 20 Percent in Last 20 Years While Housing Costs are up 56 Percent and Healthcare Costs are up 155 Percent.Posted: Thu, 28 Jan 2010 07:11:41 +0000The struggle for average Americans to keep up is largely becoming an act of will power and force in this current grand recession. Now you wouldn’t think that there is a definite war raging against the middle class if you simply follow the mainstream media but the facts speak to a more distilled and corporatized method of debt slavery. Americans are working more hours trying to stay in the same place that they believe would keep them on pace to having the American Dream. And this dream is merely the ability to afford a home, provide your children with a good education (public or private), and save enough to have a retirement that doesn’t require you to eat cat food after a lifetime of working. That is at the root of what most average Americans would want after a full working career. But we are at an inflexion point and the middle class is largely being squeezed out. A recent study from the Commerce Department shed some light on an issue that we already know. Over the past 20 years the middle class has been falling behind: Everything is relative in this world. Incomes have gone up during this time but the cost of housing, healthcare, and access to education have outpaced income gains in some cases by four to one. Money is only worth what you can buy with it. The grand housing bubble of this decade lured many into buying homes that they simply could not afford. Banks and Wall Street were more than willing to provide access to this dream since they knew if all bets crashed, and they did, that they would call on their connected politicians to bail them out and send the bill to taxpayers for their adventures in finance. Take a look at the chart above closely. Housing price changes have wiped out any gains in income. The relative amount of income needed to buy a home has put many two income households on the brink of bankruptcy. And the 4 million foreclosure filings in 2009 alone tell us that many Americans are unable to hold onto one cornerstone of the American Dream. The middle class is absolutely vital to having a sustainable and flourishing economy. The massive debt machine coming from the big banks has created a new form of debt servitude. Some would argue that this is a personal responsibility issue and I will be the first to agree with that. People should live within their means. But think of the FICO score that has become like a permanent financial report card. Some employers actually screen for credit scores before hiring applicants. Want to rent a home because you don’t want to over extend and buy a home? You better hope that FICO is up to par. And many insurance companies base their analysis on this score. So even if you never had a credit card or any debt, you would be in a bad spot because so many people rely on this number. This is only one example of how people are actually forced to use debt simply to pursue the avenues of the middle class. In fact, we have many more people simply trying to stay afloat let alone pursuing the middle class ideal. Over 37 million Americans are now part of the food stamp program, not only is this the highest number ever but also the highest percentage of Americans ever to be on food assistance: I sometimes read gut wrenching stories from the Great Depression where people would wash and reuse paper towels or have soup for weeks on end just to keep their families fed. 37 million Americans would be one step away from that existence if it weren’t for some basic safety nets. It is troubling to say the least that this patch is what is keeping this great recession from being a profound depression. Yet I think the 27 million underemployed Americans are already in that state of mind. The idea of a middle class life is slowly drifting away as each and every day we realize that our nation is becoming more of a corporatacracy. The housing nightmare really played on both ends of this middle class dream. Banks were more than willing to lend trillions of dollars to people that really could not afford the homes they were buying. This created the biggest housing bubble the world has ever witnessed and the bursting ramifications are being felt throughout the economy. Yet if you look at the equation, who is really being punished? Average Americans are being punished as they have their homes foreclosed on. Yet banks who are in the supposed position of financial experts, have not only garnered trillions in bailouts but are now back to their speculative ways. This is disturbing because it is highlighting a marked shift and a near game over for the middle class. Think of the rise of our economy in the 1940s and 1950s. Many returning GIs had access to affordable education through new programs and grants. It is the least you can offer to someone defending this country. Next, it was possible to support a family with one income because we had a strong and sustainable manufacturing base. Now, we have families with two incomes in the service sector trying to piece things together. Throw in a child, and that second income evaporates through childcare costs and educational fees. In other words, just because people have more income their buying power has collapsed. And this fact is revealed in the data that two-income households are more of an economic necessity: So of married couples with two children 76 percent have two earners. The average American is simply working to stay on track or face being thrown off the treadmill. Jobs are so important to keeping a solid middle class. This should be obvious but current policy being driven by the corporatacracy is simply focusing on keeping prices inflated for the big ticket items (i.e., housing and healthcare). At this point in the game, housing values have gone up to points that are clearly unsupportable: This being the biggest budget item for most households, you would assume that lower prices would be welcomed from the government seeing that many Americans are underemployed and those with jobs have seen stagnant wages. The middle class dream is at risk. This is a question of what we want out of our country. Are we simply obsessed on keeping home values inflated so banking giants could keep gaming accounting rules and claim billion dollar profits? If we want to prosper in the next decade, there will need to be a radical change to preserve what once was envied by the world. Otherwise, you can expect banks and their political allies to keep selling away the middle class of America. On the path we are traveling on the middle class is largely at risk for a big game over in the next decade. Commercial Real Estate and Tishman and Blackrock Walking Away from a $4.4 Billion CRE Deal. How to Lose 66 Percent on an 11,000 Unit Property. Why Walking Away from CRE is no different from Walking Away from Residential Real Estate.Posted: Tue, 26 Jan 2010 17:21:33 +0000It is becoming more of a preferred strategy to systematically walk away from commercial real estate debt. We have now had two large Wall Street organizations in Morgan Stanley and Tishman and Blackrock Inc. deciding, by voluntary choice, to walk away from their contractual obligations on commercial real estate. Now much has been made regarding the commercial real estate debacle because some $3.5 trillion in commercial real estate debt is outstanding. This number is enormous and many of the bank failures that we’ll be seeing on Fridays this year will come from bad loans in the commercial sector. Part of the problem with commercial real estate is the way deals got financed. Many of the loans are made under 5 to 10 year terms and unlike a 30 year loan, need to be refinanced at the end of the deal. Well this is a problem when the property securitizing the loan is now valued at 30, 40, or even 50 percent lower. Unlike residential real estate that saw loan and home values peak in 2005 and 2006, commercial real estate loans saw volume peak in 2008: So what we have is a similar situation as in residential real estate except it is delayed by two to three years. In other words, the major problems start this year. Bad commercial real estate deals are not something new. But this time the amount of bad loans made is astronomical because of the way the banking system securitized the loans. Just think for a minute how a loan is usually made. A careful evaluation of the property is made assuring the loan is actually reflecting the value of the underlying asset. The loan is then made under the assumption the borrower will pay the loan back under the contractual terms. If the borrower doesn’t pay the amount back, then you as a responsible lender will be able to take back a property that ideally would be valued at terms that would make a sale to recoup some money realistic. At least this was the older system of doing business. This time, property values were never realistically assessed and banks never had in their equation the possibility of taking the property back:

Now you might be asking yourself, this is a rather significant deal and certainly anyone loaning out $4.4 billion is going to make sure that they place some kind of conservative valuation on this commercial real estate deal. So how much is the property currently worth?

Now walk through this deal. The place was purchased at $5.4 billion. It was financed with $4.4 billion in commercial real estate loans. The place is now estimated to be valued at $1.8 billion. This is a $3.6 billion loss. Now the first buyers are making a conscious business decision to walk away from their obligation to pay on this property. Clearly Tishman and Blackrock have the money to make the payment if they wanted to but they don’t. But who is the big loser here? Those that they sold the securities to. This is how the banking industry is setup. It is designed to punish those who really have little knowledge of the interworking of Wall Street finance yet the current system is designed to use taxpayer money to gamble on these sorts of deals. This is what we are bailing out and why there is such outraged geared towards Wall Street. The reason this is important is because there has been this moralizing of walking away. There has been this guilt trip put on average Americans that they need to put every penny to their house payment even if it means starving. Yet here we have Wall Street organizations with billions in funds making a conscious business decision to walk away from billion dollar deals. This isn’t some homeowner unable to make a $100,000 mortgage payment on a home valued at $70,000. The bank will technically lose $30,000 in this case by taking the home back. Here, someone somewhere is going to lose billions. As John Getty once said, “If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.” And that is the core of the commercial real estate problem. Values have collapsed: By most estimates, commercial real estate values are down over 40 percent from their peak. Many loans that are now coming due for refinancing will simply fail. In fact, there are claims that many borrowers have already stopped making payments but banks simply keep rolling over the loans like some debt snowball as to avoid writing down the real value of the underlying asset. This is an enormous problem. It is amazing so little is discussed about this in the open. My guess is the government and Wall Street realize that bailing out the commercial real estate market would garner little to no sympathy from the American public. After all, these were big banks that supposedly knew a thing or two about financing big deals. So for them to come out publicly and say they had no idea, which is really the reality, would not play well in bailing out a $3.5 trillion industry. The bottom line is someone is going to pay and so far most of the paying has come from the American taxpayer through bailouts to the corporatacracy. | Categories |